Correllengua

Fem viva la flama de la llengua!

Moviment que promou la llengua i la cultura catalanes

Antecedents

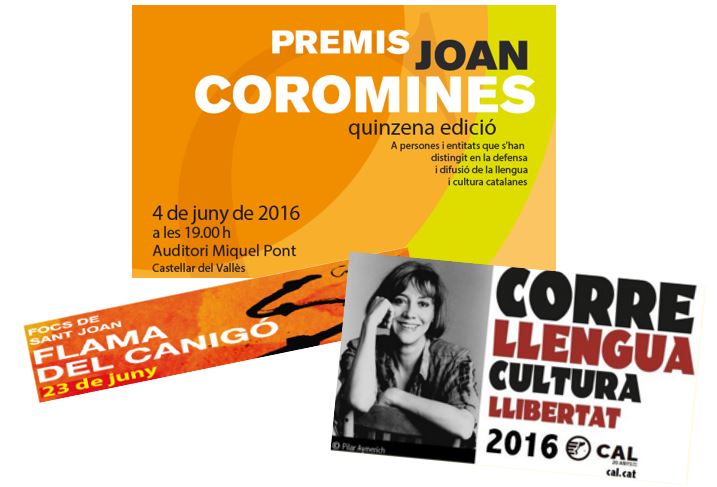

Des de l’any 1996 el Correllengua treballa per a la difusió de l’ús de la llengua i la promoció de la cultura popular de les terres de parla catalana, des d’una aposta lúdica, festiva, participativa i transversal. La CAL és una de les principals entitats que promocionen el moviment.

El Correllengua va sorgir l’any 1993 a l’illa de Mallorca, inspirat en la Korrika del País Basc, amb la finalitat de demostrar la vitalitat de la llengua catalana i fomentar-ne l’ús social. El 1995 es va començar a fer al País Valencià i a partir del 1996 la CAL va agafar el compromís de portar el moviment a la resta dels territoris de parla catalana.

La CAL exerceix la coordinació del Correllengua al Principat i a la Catalunya Nord, en coordinació amb les entitats de cada territori, mentre que al País Valencià l’exerceix Acció Cultural del País Valencià (ACPV). A l’illa de Mallorca, el Correllengua no se celebra cada any, sinó que es va alternant amb l’Acampallengua. Des de fa uns anys, la coordinació a Mallorca va de la mà de l’entitat Joves de Mallorca per la Llengua.

Vídeo de commemoració dels 25 anys del Correllengua.

El moviment

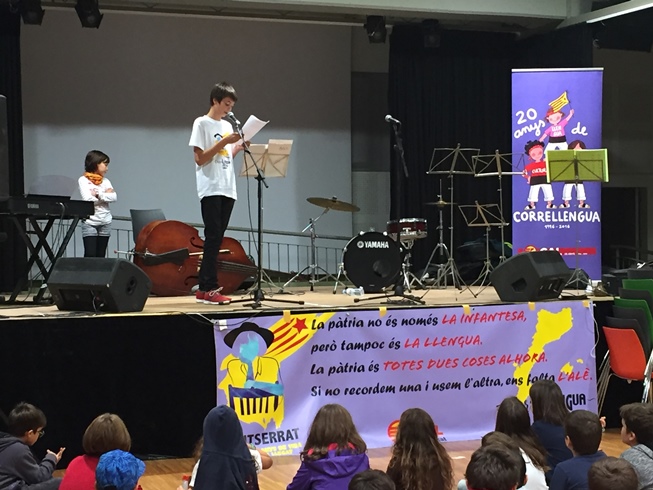

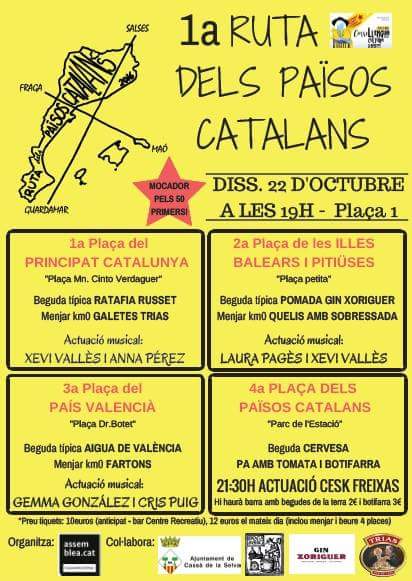

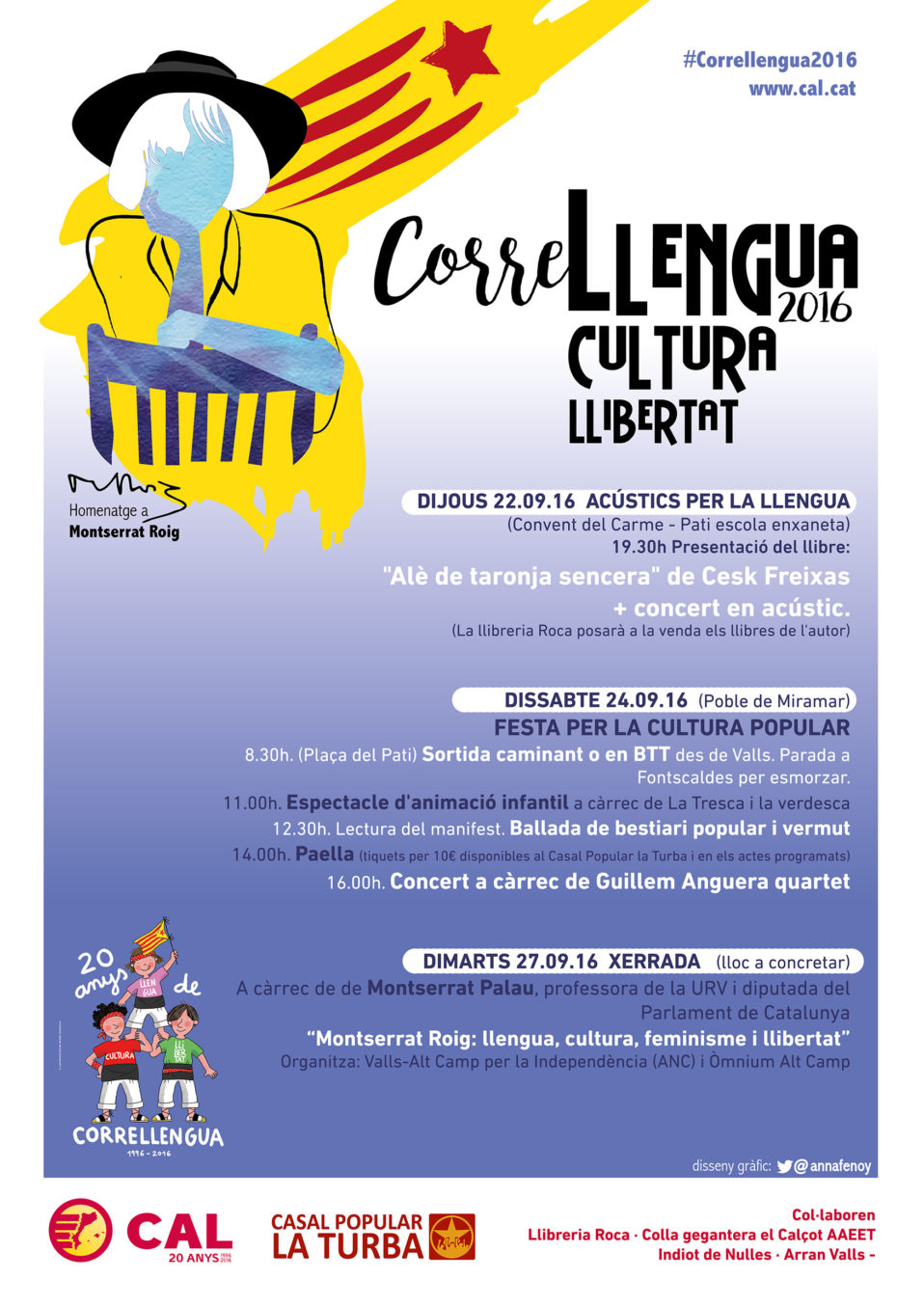

El Correllengua es vertebra amb l’encesa de la Flama, l’element simbòlic i cohesionador de tota aquesta iniciativa, tal com també ho és la lectura del Manifest del Correllengua. A banda, es realitzen tota mena d’activitats de caire lúdic, festiu, pedagògic i reivindicatiu: xerrades, taules rodones, programes de ràdio i televisió, música i balls populars, actes gastronòmics, cercaviles, teatre al carrer, concerts… amb l’objectiu de mostrar la vitalitat de la nostra llengua i cultura a totes les persones que, nouvingudes o no, encara no la coneixen. Alhora, pretén implicar tothom en la seva defensa. En definitiva, una manera festiva i oberta de celebrar la catalanitat, al carrer, sense complexos i en positiu.

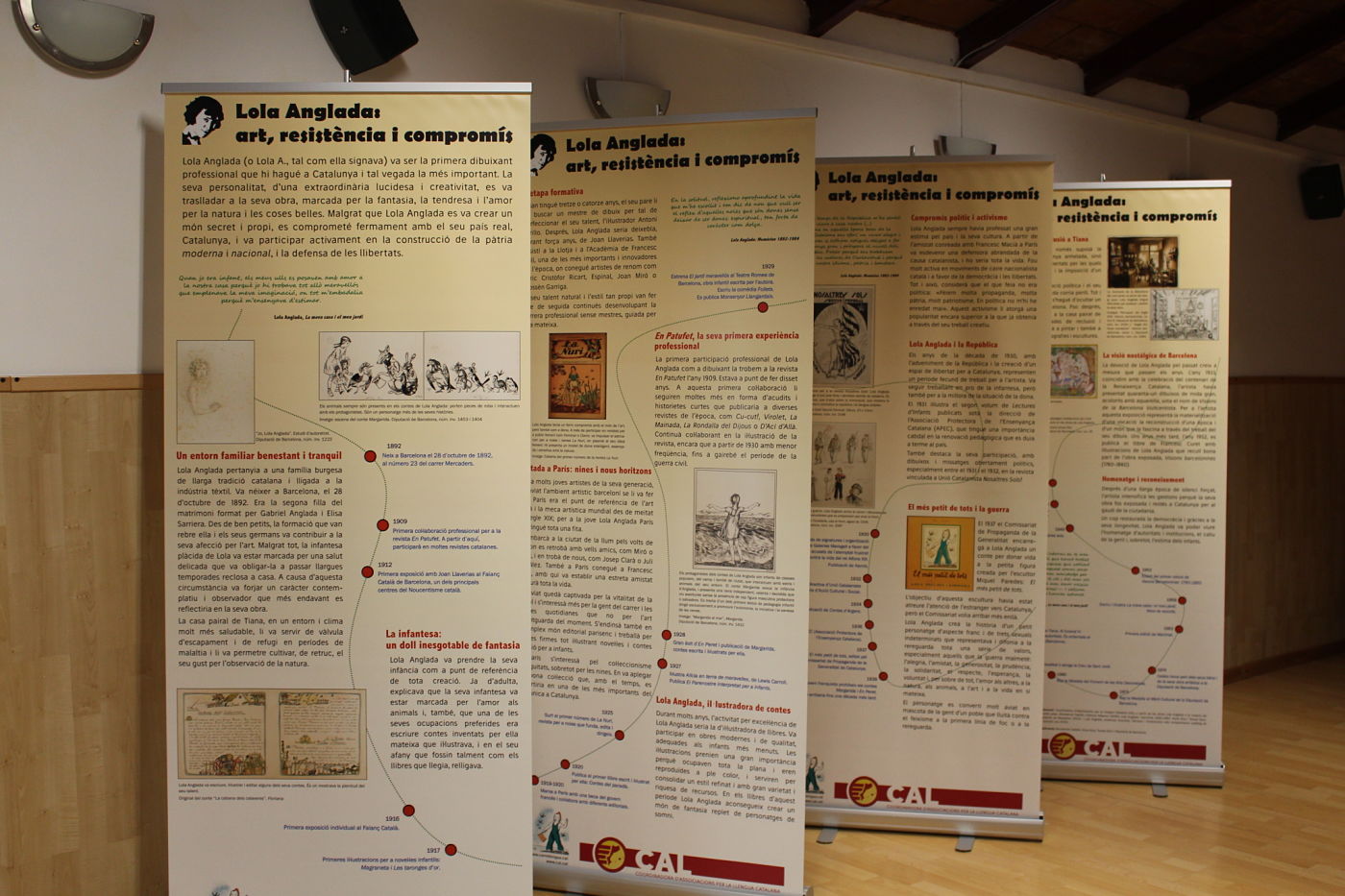

A més, el Correllengua sempre ha volgut reconèixer i retre homenatge a la vida i l’obra d’escriptors, artistes o activistes que s’han significat per la seva vàlua i també pel seu compromís envers la llengua i la cultura catalanes. A continuació s’inclou la relació dels autors o experiències a qui s’ha dedicat edició a edició:

- 2023 – Joan Brossa

- 2022 – Joan Fuster

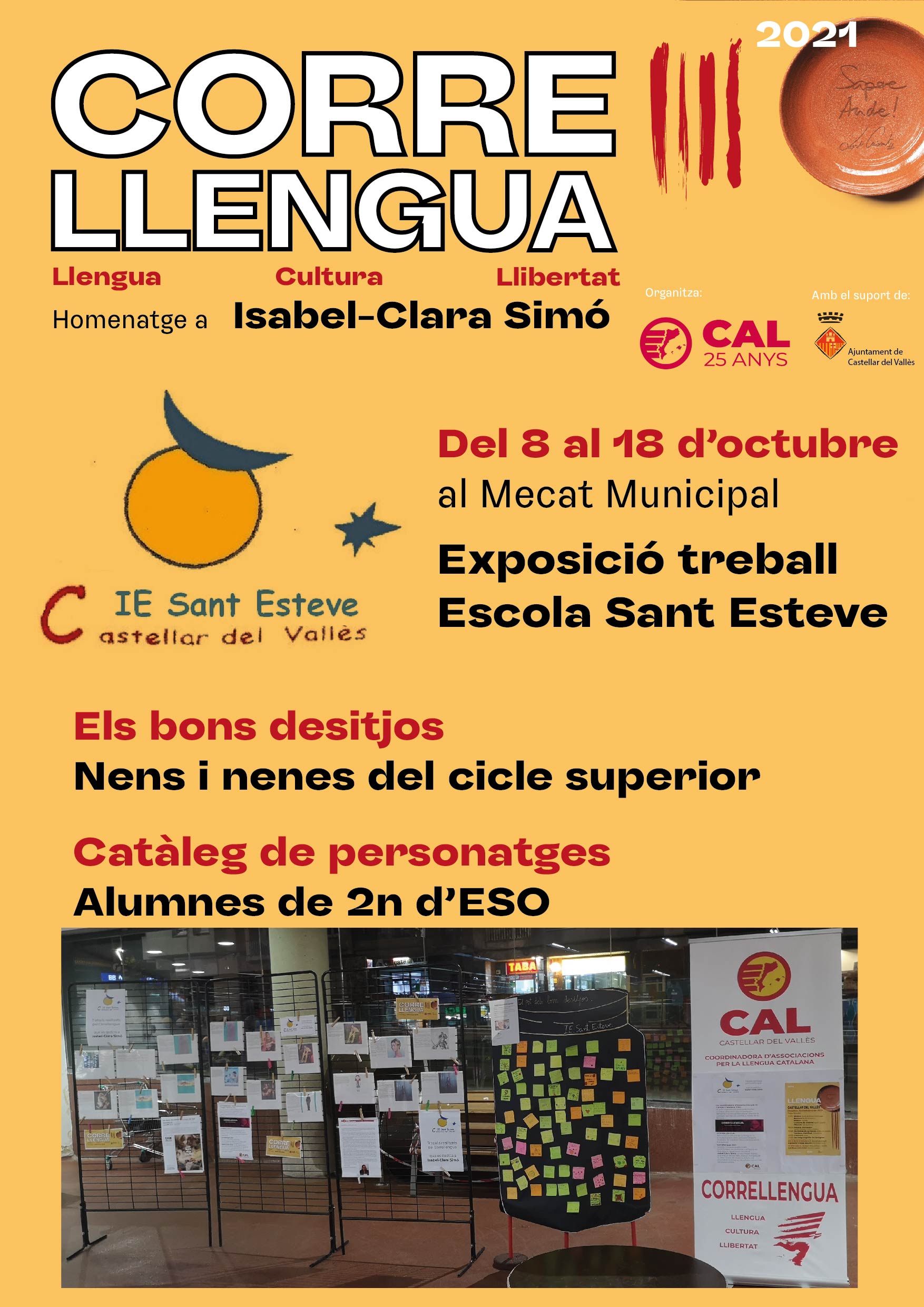

- 2021 – Isabel-Clara Simó

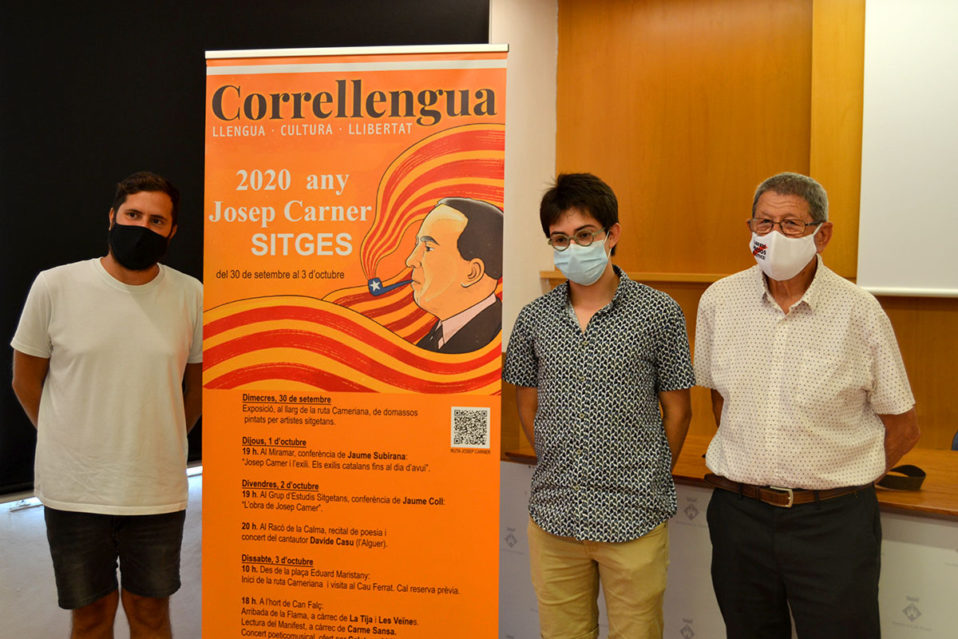

- 2020 – Josep Carner

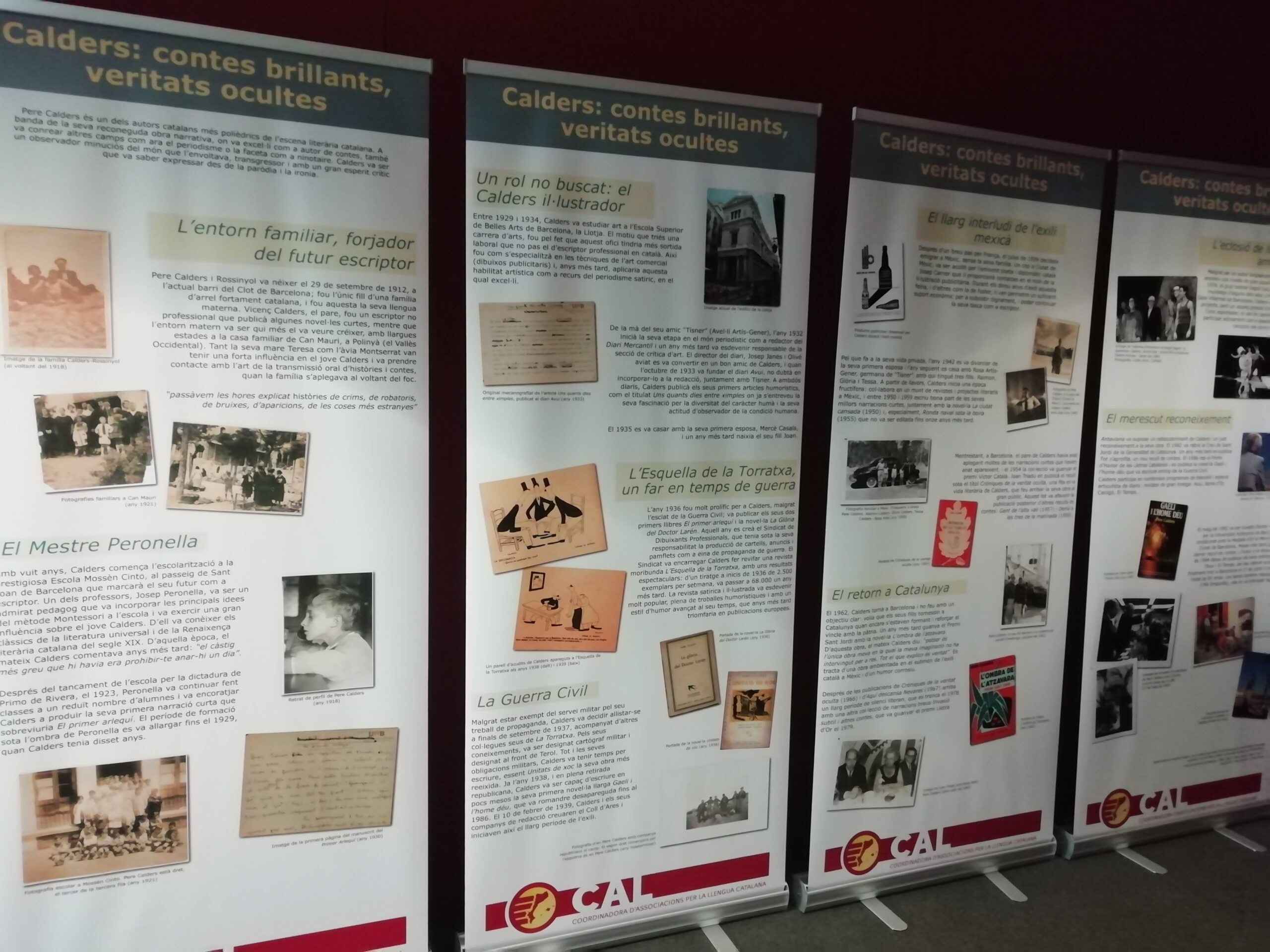

- 2019 – Pere Calders

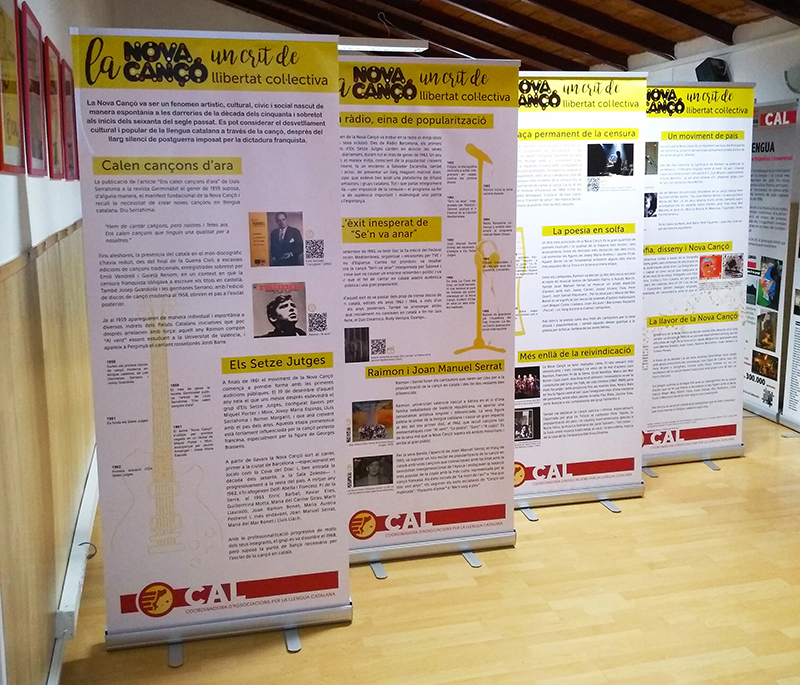

- 2018 – Moviment ‘Nova Cançó’

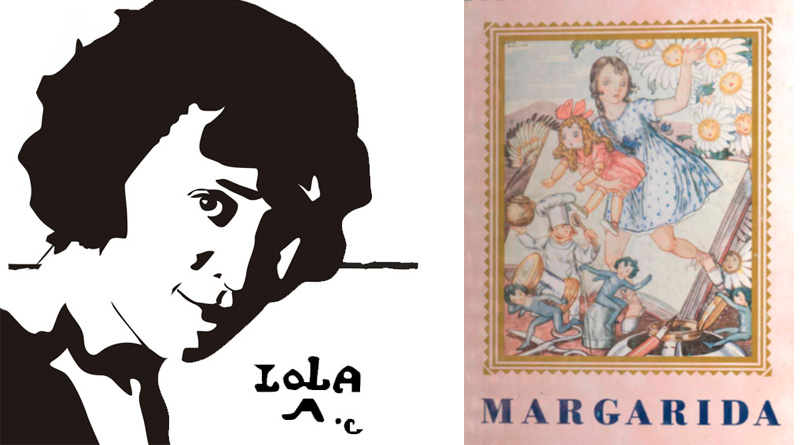

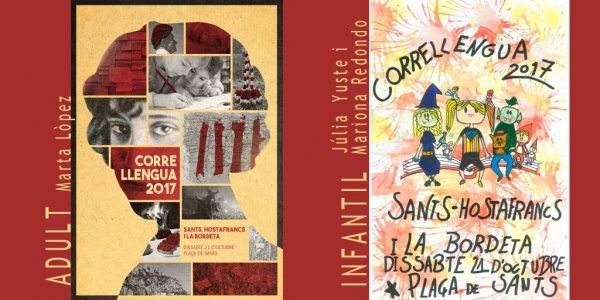

- 2017 – Lola Anglada

- 2016 – Montserrat Roig

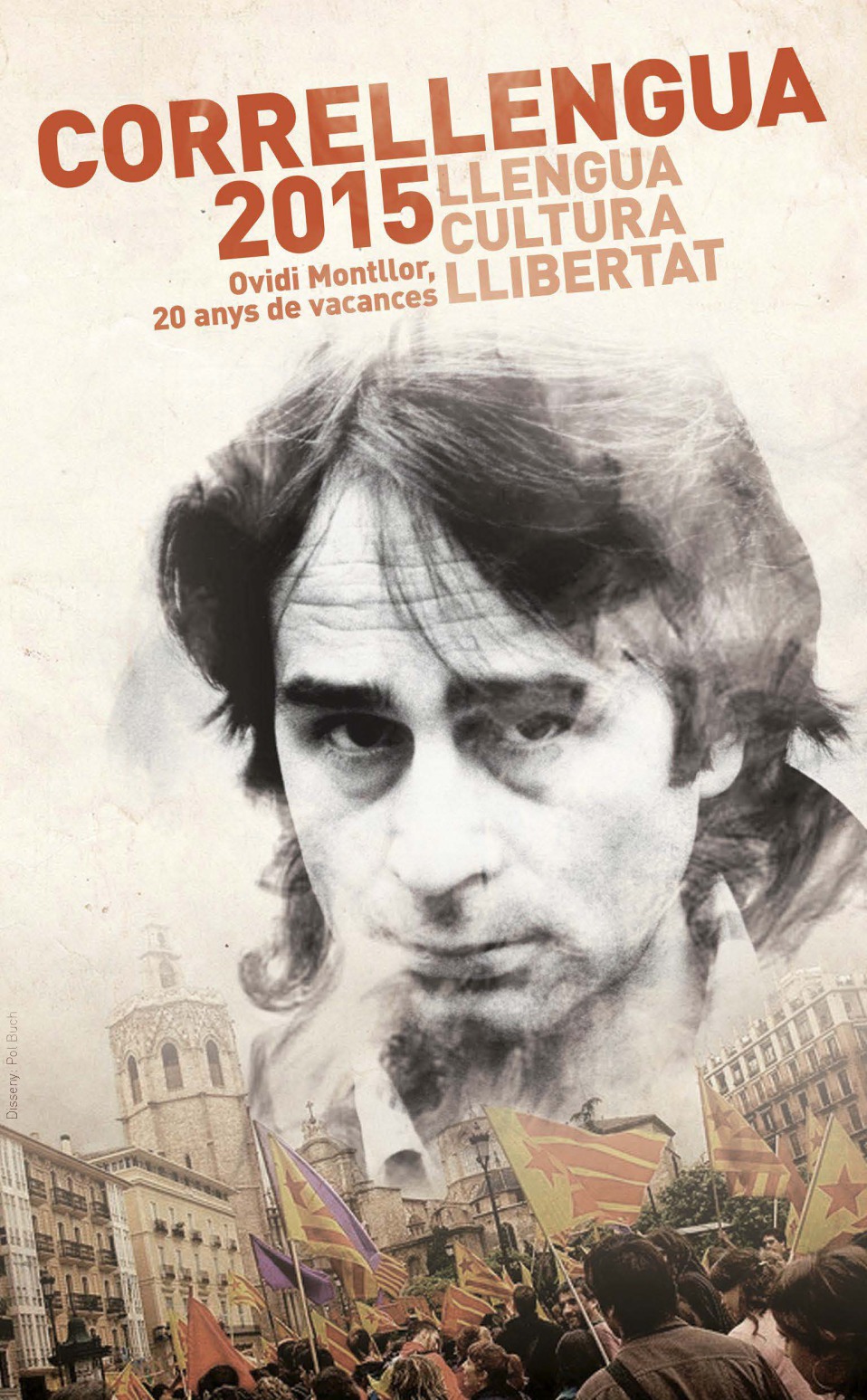

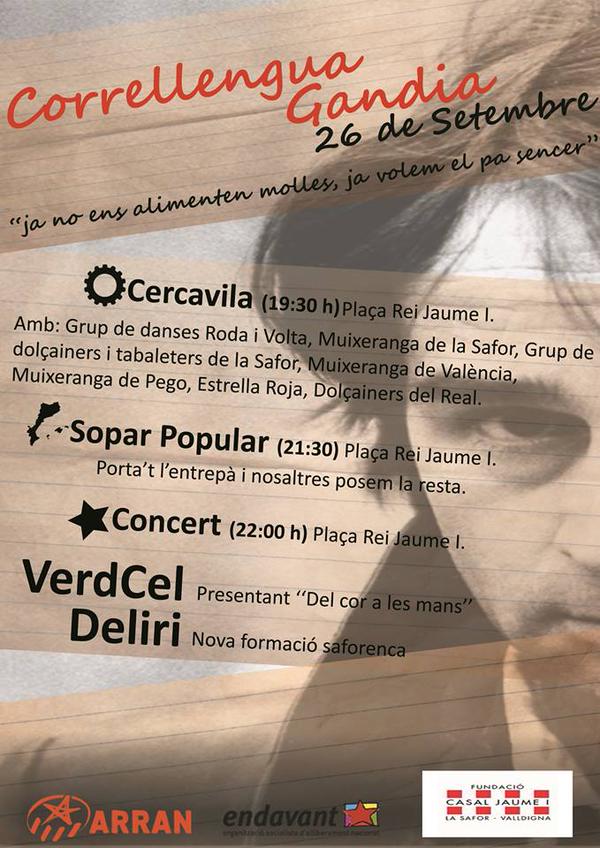

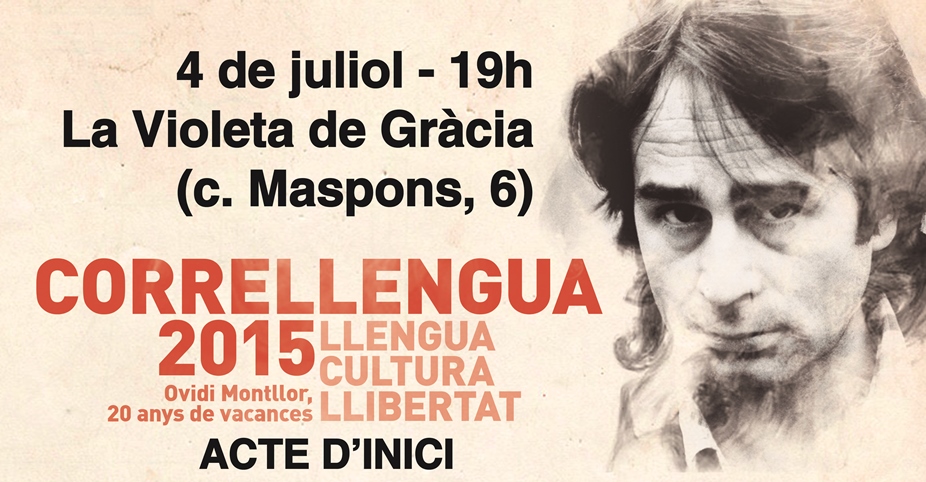

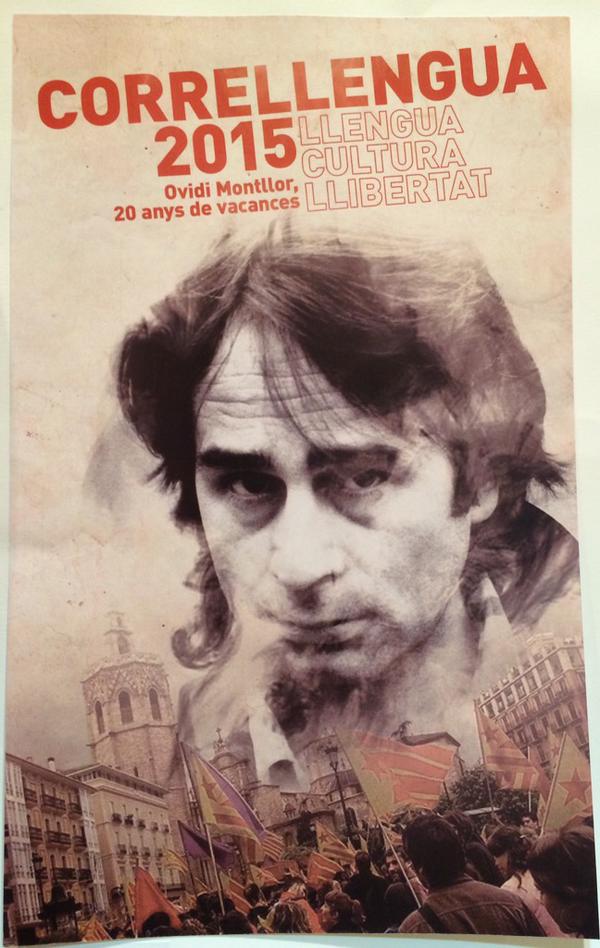

- 2015 – Ovidi Montllor

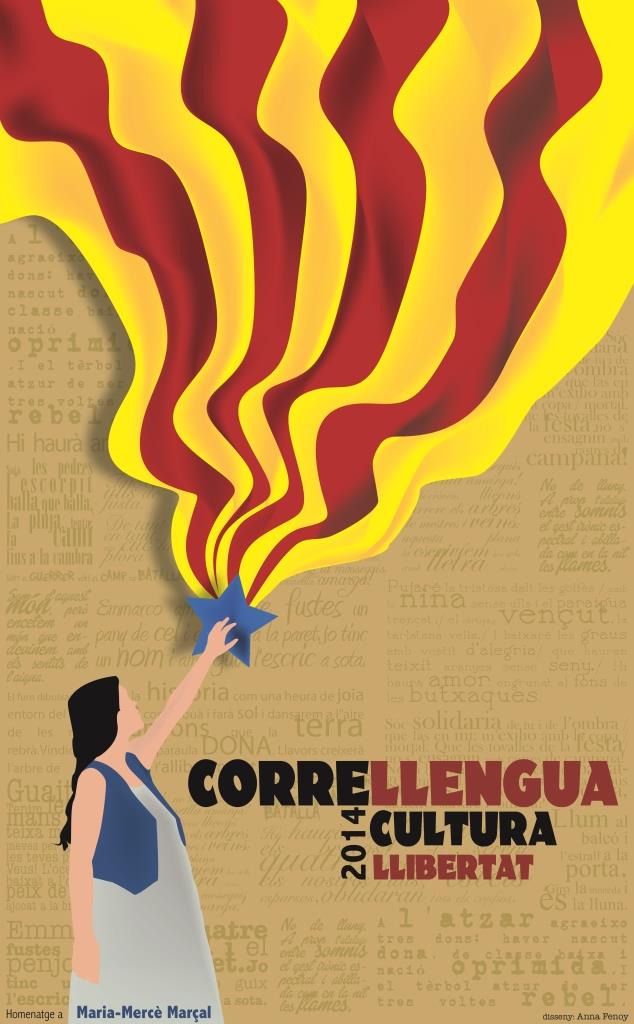

- 2014 – Maria-Mercè Marçal

- 2013 – Miquel Martí i Pol

- 2012 – Lluís Maria Xirinacs

- 2011 – Joan Oliver “Pere Quart”

- 2010 – Salvador Espriu

- 2009 – Manuel de Pedrolo

- 2007/2008 – Maria Aurèlia Capmany, Montserrat Roig, Pere Quart i Jaume Fuster

- 2005/2006 – Guillem d’Efak, Avel·lí Artís Gener “Tísner”, Jesús Moncada i Ovidi Montllor

- 2003/2004 – Lola Anglada, Vicent Andrés Estellés, Jaume Fuster i Francesc de Borja Moll

- 2001/2002 – Maria-Mercè Marçal, Ramon Barnils, Ovidi Montllor i Mercè Rodoreda

Vull organitzar un Correllengua. Com puc fer-ho?

Qualsevol col·lectiu, entitat o conjunt d’entitats d’un poble o comarca pot organitzar un Correllengua. També el poden impulsar ajuntaments, oficines locals de català o altres agents de dinamització cultural d’un territori.

Tot i que habitualment hi ha una entitat que engega la iniciativa, normalment recomanem que es busqui la participació i complicitat del màxim nombre de col·lectius (entitats de cultura popular i tradicional, biblioteques, escoles…) per tal que el Correllengua sigui transversal i obert a tothom.

El Correllengua és una iniciativa de la societat civil. Per tant, les organitzacions polítiques podran adherir-se al Manifest i donar suport als actes, però en cap cas podran ser-ne les organitzadores directes. Tot i això, els seus membres poden participar-hi a títol individual.

Per dur a terme l’organització d’un Correllengua, en primer lloc, és necessari implicar el màxim nombre de col·lectius i agents del territori (entitats culturals, organitzacions sensibilitzades amb la llengua, agrupacions de cultura popular i tradicional, escoles, biblioteques…) i constituir una Comissió del Correllengua encarregada d’organitzar els actes. Aquesta Comissió designarà una persona que serà qui interlocutarà amb la CAL: s’hi posarà en contacte via telèfon (93 415 90 02) o correu (correllengua@cal.cat) i informarà dels aspectes clau: quan s’ha previst celebrar el Correllengua, on es farà, quina és la programació i si necessita algun material de la CAL.

A més a més, es pot col·laborar fent una aportació, realitzant una transferència bancària al següent número de compte ES64 2100 0780 1902 0008 5432 i indicant a l’apartat concepte: “Aportació Correllengua”.

Les donacions individuals contribueixen a enfortir el moviment. Permeten generar nous recursos que es posen a disposició dels organitzadors locals, com pancartes, exposicions i altres elements d’imatgeria, així com elements de divulgació del personatge a qui es dedica el Correllengua: audiovisuals i materials didàctics, entre d’altres.

Preguntes freqüents

Com puc donar suport al Correllengua?

Si sou un col·lectiu, podeu adherir-vos al moviment. Per fer-ho, només cal que comuniqueu el vostre suport enviant un correu a correllengua@cal.cat i us incorporarem a la llista d’entitats adherides. També podeu organitzar el Correllengua al vostre barri, vila o comarca.

Si vols donar suport a títol individual, pots contribuir al moviment fent un donatiu, adquirint material promocional o bé col·laborant com a voluntari.

Qui pot organitzar el Correllengua?

Qualsevol col·lectiu, entitat o conjunt d’entitats d’un poble o comarca. El Correllengua també el poden impulsar ajuntaments, oficines locals de català o altres agents de dinamització cultural d’un territori.

Tot i que habitualment hi ha una entitat que engega la iniciativa, normalment recomanem que es busqui la participació i complicitat del màxim nombre de col·lectius (entitats de cultura popular i tradicional, biblioteques, escoles…) per tal que el Correllengua sigui transversal i obert a tothom.

El Correllengua és una iniciativa de la societat civil, per tant, les organitzacions polítiques podran adherir-se al Manifest i donar suport als actes, però en cap cas podran ser-ne els organitzadors directes. Tot i això, els seus membres poden participar-hi a títol individual.

Vull organitzar un Correllengua. Com puc fer-ho?

En primer lloc, és necessari implicar el màxim nombre de col·lectius i agents del territori (entitats culturals, organitzacions sensibilitzades amb la llengua, agrupacions de cultura popular i tradicional, escoles, biblioteques…) i constituir una Comissió del Correllengua encarregada d’organitzar els actes. Aquesta comissió designarà una persona que serà qui conversarà amb la CAL: s’hi posarà en contacte via telèfon (93 415 90 02) o correu (correllengua@cal.cat) i informarà dels aspectes clau: quan s’ha previst celebrar el Correllengua, on es farà, quina és la programació i si necessita algun material de la CAL. Podeu trobar més informació sobre com s’organitza el Correllengua al dossier per a organitzadors (disponible a aquest apartat).

A més a més, si som un Ajuntament….

Podeu donar suport el Correllengua a través de la moció de suport al moviment (disponible a aquest apartat).

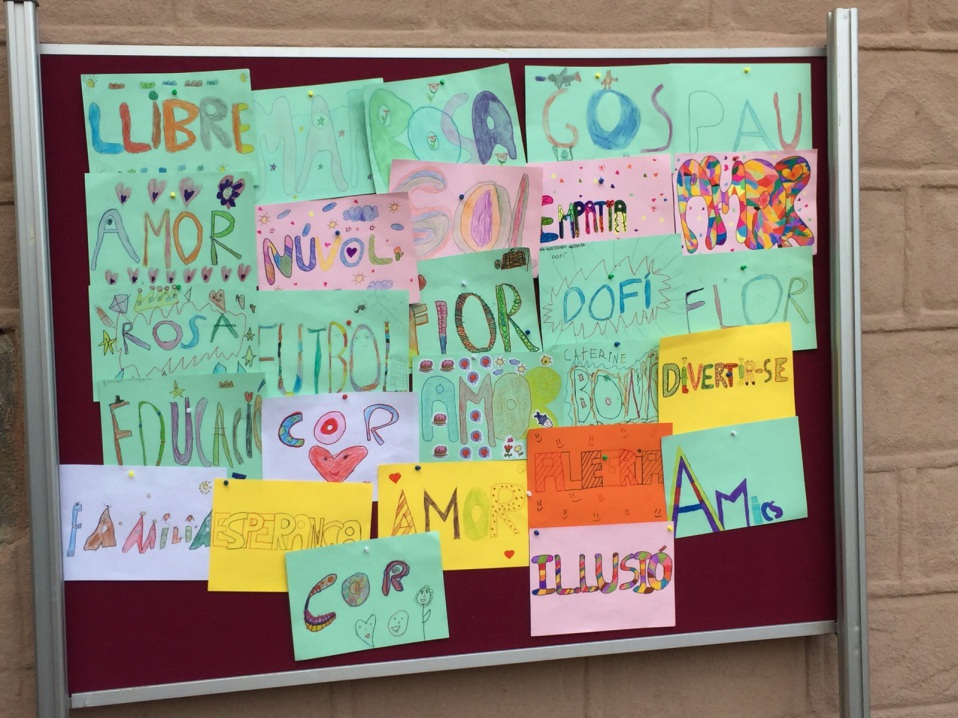

Si som una escola…

Podeu portar el Correllengua al vostre centre a través de les propostes didàctiques. Aquestes activitats es poden treballar al llarg del curs.

Quan s’ha de celebrar, el Correllengua?

Per tal de dotar el Correllengua de sentit unitari, els actes locals s’haurien de celebrar preferentment entre principis de juliol i principis de novembre, moment en què es clou el moviment. En alguns casos, i en funció dels calendaris locals, alguns actes també es poden programar fora d’aquestes dates.

Així mateix, per tal d’evitar la concentració d’actes en un mateix cap de setmana en una mateixa comarca o ciutat, és desitjable que hi hagi una mínima coordinació dins un mateix territori. La CAL pot facilitar aquesta informació.

Quines activitats puc fer?

Cada Comissió organitzadora decideix les activitats que consideri oportunes. En tot cas, la programació ha de seguir els objectius marc del moviment i han de ser obertes i participatives.

Hi ha dos elements comuns que són presents a cada Correllengua i que cal procurar incorporar en el programa d’actes: l’encesa de la Flama del Correllengua i la lectura del Manifest.

També és important que els organitzadors es facin seva la temàtica de l’any en curs. Al Dossier d’organitzadors del Correllengua hi trobareu diferents recursos i propostes per organitzar actes de record i divulgació de la seva figura.

Al Dossier de l’Empentallengua hi trobareu més idees d’activitats que us poden ajudar a farcir de contingut les programacions. Des de la CAL ens posem a la vostra disposició per resoldre dubtes i ajudar-vos en tot allò que necessiteu.

Com han de ser els actes?

Un dels principis bàsics que regeixen el Correllengua és la voluntat de normalitat. En aquest sentit, hem de procurar que els actes siguin oberts, participatius i populars. Hem d’anar un pas més enllà i intentar engrescar segments de població poc propers o sensibilitzats amb la causa, especialment les persones nouvingudes, les que no parlen català habitualment i aquelles que no són conscients de la importància de parlar-lo.

Cal obrir portes, convidar tothom participar del Correllengua, fer nous contactes. Per això, els actes s’han de fer preferiblement en espais oberts i de fàcil accés, o bé en llocs de referència pensats per a la majoria.

Com es financen els actes?

Part del cost del disseny, la projecció i la realització de les activitats de cada Correllengua l’assumeix la pròpia organització d’acord amb les iniciatives que consideri oportunes: aportacions de les entitats integrants de la Comissió organitzadora, suport institucional, subvencions públiques, donacions individuals i venda de material.

Malauradament, la CAL no pot subvencionar o cobrir despeses dels actes locals, però pot aportar material de préstec i altres productes que es poden comercialitzar i ajudar a finançar les activitats: samarretes, llibres, CD, bons d’ajut…

Una altra possible font d’ingressos és l’adhesió de comerços o entitats que col·laborin econòmicament o bé aportin productes o altres.

En què pot ajudar-nos, la CAL?

Com a promotora del Correllengua, posem a la vostra disposició diversos materials de préstec (exposicions, jocs, pancartes i altres elements d’imatge del Correllengua). Podeu veure quins són al dossier d’organitzadors del Correllengua (disponible a aquest apartat).

També facilitem el cartell mut del Correllengua, la imatge comuna del moviment, perquè hi inseriu la vostra programació. Podeu descarregar-los aquí.

A més, oferim un ampli ventall de productes promocionals que serveixen per ajudar a finançar els actes i difondre la iniciativa. Podeu consultar-ne tots els detalls al dossier.

A banda dels materials i recursos que oferim, la CAL fa d’altaveu del Correllengua. Fem difusió dels actes que es fan al territori a través d’aquest web, del butlletí del Correllengua i també a les xarxes socials. A més, tota l’activitat es plasma al Mapa del Correllengua, l’eina que mostra de forma actualitzada l’estat del moviment a tots els punts del territori.